Essential information

Foreign Direct Investment grew 110% in the first half and reaches US$6,570 million

If a broader comparison basis is considered, net inflows in the period increased by 25% compared to the 2015-2019 five-year average.

Foreign direct investment (FID) in the first half of 2019 registered a recovery compared to the two previous years with a net inflow of US$6,570 million and a net inflow of US$1,679 million in June alone, according to figures published today by the Central Bank. The January-June period figure represents growth of 110% compared to the same period in 2018, when inflows reached US$3,131 million.

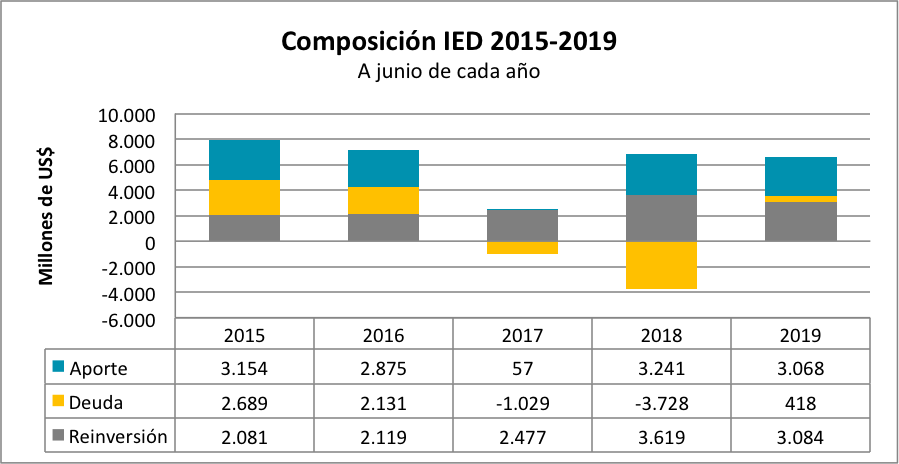

If a broader comparison base is considered, the net inflow of US$6,570 million represents an increase of 25% compared to the 2015-2019 five-year average (US$5,251 million). The significant percentage growth in 2019 is a result of the previous year’s low comparison base, a result of the volatility of intercompany debt transactions, one of the components of FDI.

The director of InvestChile, Cristián Rodríguez Chiffelle, said the figure reflected the permanent interest of foreign investors in the country but noted “one has to be clear that this figure is satisfactory but is not one to celebrate, considering the movement of both inward and outward capital.”

“While the growth percentage is correct, it also has to do with the volatility of investment flows in 2018, it is a good step for the remainder of the year, especially if we take into account that in the first half of 2019 we already have similar inflows to those of the whole of last year,” said Rodríguez.

With respect to the composition of FDI in the first half of this year, equity transactions reached US$3,068 million, similar to the US$3,084 million corresponding to reinvestment of earnings, while debt totalled US$418 million. It is worth noting that the volatility of intercompany debt flows overly impacts total FDI flows, while the other components are within historical ranges since homogeneous records have existed.